The Economy Is Bouncing Back and Businesses Need a Strategy for Growth

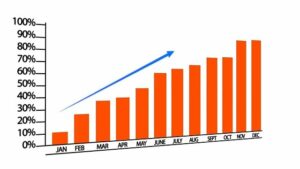

As vaccinations roll out and businesses reopen, there is a big opportunity for growth across all industries. For businesses to take full advantage of this updraft, they need to rethink their growth strategy, as well as the impact of using traditional loans to finance their plans for expansion.

How Loans Affect Business Growth

How Loans Affect Business Growth

Loans have been the traditional method used by businesses to expand operations. Traditional lending channels, such as banks, through the Great Recession of 2008 was a setback, and to protect themselves they raised requirements for borrowers while lowering lending limits. 2020 caused a number of businesses – through no fault of their own – to place operations on hold or close their doors completely. Paycheck Protection Program (PPP) loans has limited availability, and not many businesses were able to access them. As soon as the government-backed funds ran out, banks were startled and tightened their practices even further. Requirements for credit and collateral skyrocketed, as did turndowns on loans for businesses that banks and other lenders deemed to be “high risk.” In that time, businesses had a chance to assess how loans impact their operations, even during a period of growth.

Loans provide single-use capital while lowering credit ratings and placing debt on the books. During a period of growth, that debt means businesses need to put up collateral and allocate a portion of revenue to paying off the balance. During growth, this can place a major strain on cash flow and prevent businesses from reaching their potential. During an economic upswing, businesses should be able to achieve growth without being held back by red tape, prohibitively high requirements, and low lending limits. In a sense, the pandemic gave entrepreneurs the time they needed to really analyze how loans affected their businesses, and to find new options to sustain and grow their operations.

A Strategy for Growth without Loans

In order for businesses to achieve growth free of debt, they need strong cash flow and ample capital reserves. However, unpaid receivables are usually the main obstacle in reaching those goals. To pivot away from debt-based financing, businesses use factoring services to unlock revenue from unpaid receivables and build up capital reserves from growth. Factoring turns unpaid customer invoices into cash, which accelerates the cash flow pipeline so businesses can build up the reserves they need to expand without relying on debt-based loans or dealing with delays from red tape. Invoice factoring is structured around existing receivables, so business credit ratings do not enter the picture. Because the receivables already exist, they can be leveraged for immediate capital so businesses can thrive and grow without jumping through hoops to get approved for traditional debt-based loans.

At Single Point Capital, we offer fast and comprehensive factoring services so our clients can access the funds from their invoices within a single day. Our team is focused on providing your business with factoring solutions tialored to your needs, so you can reach your goals quickly, efficiently, and without placing any debt on the balance sheet. To get started, contact our offices today.